ROIX

FOREX - RISK OVER REGRET

ROIX

FOREX - RISK OVER REGRET ROIX

FOREX - RISK OVER REGRET

ROIX

FOREX - RISK OVER REGRET1.0 TYPES OF TRADING STRATEGIES

1.1 DAY TRADING

1.2 POSITION TRADING

1.3 SWING TRADING

1.4 SCALPING

2.0 MONEY MANAGEMENT

2.1 DEFINING MONEY MANAGEMENT

2.2 IMPORTANCE OF MONEY MANAGEMENT

2.3 APPLICATION OF MONEY MANAGEMENT IN TRADING

2.4 RISK AND REWARD RATIO

3.0 MANAGING EMOTION

4.0 DEVELOPING PERSONALIZED TRADING PLAN

5.0 MY MORNING ROUTINE

In this final chapter, there will be very important areas covered to trade with confidence in financial market. By now, you should have learnt all the basics, foundation to advance your business project or career through understanding trading opportunities, reading charts, understanding fundamental factors. In this chapter, main reasons to say so, are that it is important to understand your risk measurement, compounding financial growth, emotion management, money management, keeping personal trading journal and some important trading methods by general trading techniques already existing and methods discovered through market research by different analysts.

Today, people trading in the Forex Market are on a rise in figures, that is because that is the best platform or business project anyone can become financially stable. There are many researched reasons to say so, such as no big capital requirement to start yourself into bigger leverage and you don’t have to employ many people to start things in action, all you need to employ is yourself with sufficient information and knowledge and financial news feeds to get updated on what happens next.

Many people still fail despite such big cycle of money every day operated, $5.3 trillion dollar a day in Foreign Exchange Market that is simply because most of the fresh traders do not invest time into studying on trading techniques, failure of bad trades is due to understanding why they took so such trades. Therefore, in this final chapter, Mr. Roix finalized some methods that can be used to trade for potential traders in Financial Market.

Generally, we have also gathered all the information available in trading techniques on the Internet and in order to make an ease of understanding the Financial Market, most common used trading techniques shared on websites are following methods. In the last part, there are some tips again that Mr. Roix practices.

Active

trading is the act of buying and selling securities based on

short-term movements to profit from the price movements on a short-term

Forex

chart. The mentality associated with an active trading strategy differs

from

the long-term, buy-and-hold strategy. The buy-and-hold strategy employs

a

mentality that suggests that price movements over the long term will

out weight

the price movements in the short term and, as such, short-term

movements should

be ignored. Active traders, on the other hand, believe that short-term

movements and capturing the market trend are where the profits are

made. There

are various methods used to accomplish an active trading strategy, each

with

appropriate market environments and risks inherent in the strategy.

Here

are four of the most common types of active trading and the

built-in costs of each strategy. (Active trading is a popular strategy

for

those trying to beat the market average.)

Day trading is perhaps the most well-known active-trading style. It is often considered a pseudonym for active trading itself. Day trading, as its name implies, is the method of buying and selling securities within the same day.

Positions are closed out within the same day they are taken, and no position is held overnight. Traditionally, day trading is done by professional traders, such as specialists or market makers. However, electronic trading has opened up this practice to novice traders.

Some consider position trading to be a buy-and-hold strategy and not active trading. However, position trading, when done by an advanced trader, can be a form of active trading. Position trading uses longer term charts – anywhere from daily to monthly – in combination with other methods to determine the trend of the current market direction. This type of trade may last for several days to several weeks and sometimes longer, depending on the trend. Trend traders look for successive higher highs or lower highs to determine the trend of a security. By jumping on and riding the “wave”, trend traders look to determine the direction of the market, but they do not try to forecast any price levels. Typically, trend traders jump on the trend after it has established itself, and when the trend breaks, they usually exit the position. This means that in periods of high market volatility, trend trading is more difficult and its positions are generally reduced.

When a trend breaks, swing traders typically get in the game. At the end of a trend, there is usually some price volatility as the new trend tries to establish itself. Swing traders buy or sell as that price volatility sets in. Swing trades are usually held for more than a day but for a shorter time than trend trades. Swing traders often create a set of trading rules based on technical or fundamental analysis; these trading rules or algorithm are designed to identify when to buy and sell a security. While a swing-trading algorithm does not have to be exact and predict the peak or valley of the price move, it does need a market that moves in one direction or another. A range-bound or sideways market is a risk for swing traders.

Scalping is one of the quickest strategies employed by active traders. It includes exploiting various price gaps caused by bid/ask spreads and order flows. The strategy generally works by making the spread or buying at the bid price and selling at the ask price to receive the difference between the two price points. Scalpers attempt to hold their positions for a short period, thus decreasing the risk associated with the strategy. Additionally, a scalper does not try to exploit large moves or move high volumes; rather, they try to take advantage of small moves that occur frequently and move smaller volumes more often. Since the level of profits per trade is small, scalpers look for more liquid markets to increase the frequency of their trades. And unlike swing traders, scalpers like quiet markets that aren’t prone to sudden price movements so they can potentially make the spread repeatedly on the same bid/ask prices.

Money Management is the process of budgeting, saving, investing, spending or otherwise in overseeing the cash usage of an individual or group. The predominant use of the phrase in Financial Markets is that of an investment professional making investment decisions for large pools of funds, such as mutual funds or pension plans.

Money Management is twice as important as strategy is because if you take more risk than what you are supposed to, you out yourself in a position where your account can be badly managed when the trade goes against you. It is important to remember a fact that no business earns everyday a profit so trading in financial market as well sometimes you can’t win every trade. Thus, if you do not have tight rules in place to control your losses, one loosing trade with slack money management can put your trading account on life support. Your account would be in a position where it takes more “effort” to recover after it suffers a significant drawdown. Therefore, it is important to stick to 2% risk per trade – it will repay you with huge dividends many times over if you follow strictly over the time.

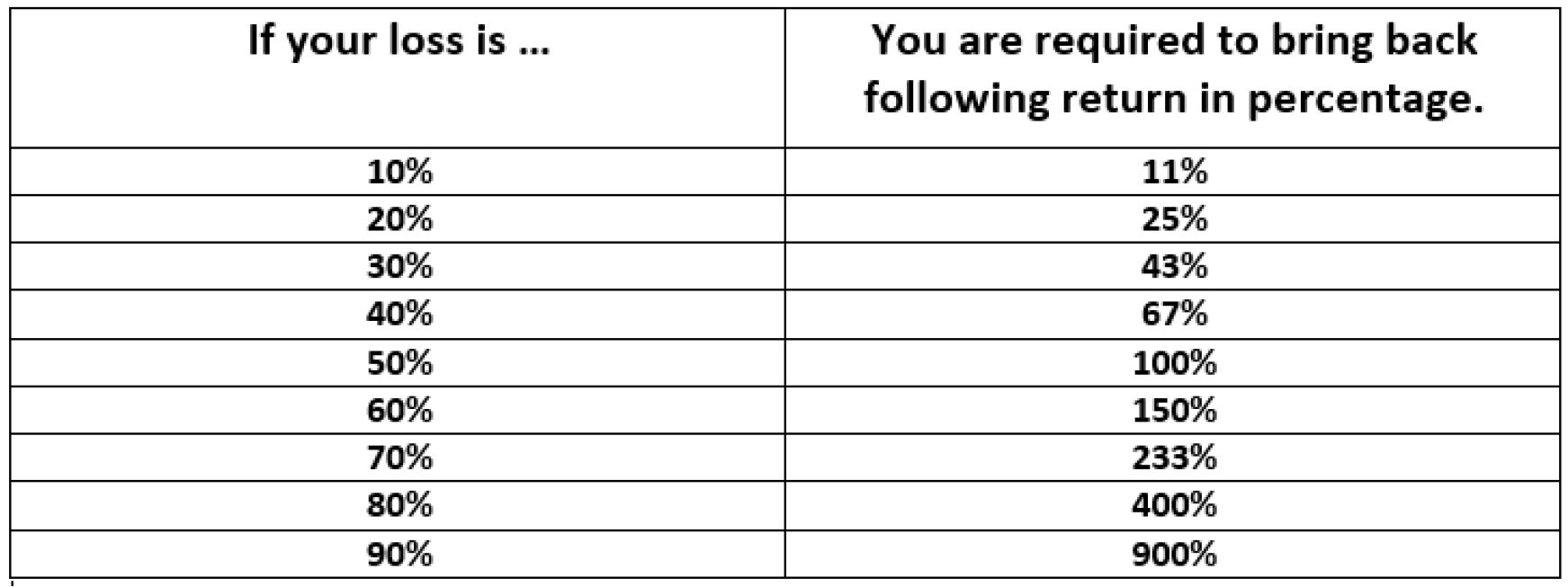

Start a trading with an account size of $10,000. You hit a bid trade and lost 50% of the account size. You have now left only $5,000. In order to bring back your trading account back to breakeven level of $10,000 you would need to achieve following fact table.

From the table, it is obvious that if you have lost your 50% of your initial capital, you would have to earn a 100% capital to bring back your account just to breakeven. To put it simply, it is easy to lose money, and it is a lot more difficult to earn it back. This is the reason why traders need a much longer time to build back an account when they make one wrong move, even upon experiencing a profitable trade at the beginning. Therefore, always amateurs are concerned with how much they can make and professionals are concerned with how much they will lose. Therefore, it is important to understand risk management in the first place.

In order to stick to risk management correctly, you need to have strict rule. Here is a formula :

Professional

trader never risks more than 2% – 5% risk of the initial

capital, never and how professionals do it, simple formula below. Stay

Professional.

Risk

= (Lot size X Stop

loss X Pip Value) / Capital

The

core idea of calculating the lot size by managing risk at 2%. When

every calculation is re-organized, following structure will come out:

This is to create an environment for yourself away from computer where you do not have always to watch the prices and drive yourself emotional about it. Rather you have the perfect risk-reward ratio and perfect opportunity set and just leave it. This gives firstly freedom of time and family time. Most people think trading requires much time and keep them busy but actual truth is completely opposite, if you know what you are doing professionally.

Preferably,

as a trader you should look for trade setups with a

risk/reward of at least 1:2, by getting a risk/reward of 1:2 on every

trade

setup, you can lose on well over 50% of your trades and still make

money.

Therefore, risk/reward is the key to a successful door, if you execute

it

properly you can make consistent money over a period. Yet, many traders

mess it

up or limit its power by meddling in their trades once the trading

account has

been changed to live account, usually this means they take less than

1:2

profit, and then enter another trade that is lower-probability, and

maybe take

a loss. Once you start this game of meddling with your trades and

interfering

with the power of risk reward scenarios, you really put limits on what

you can

achieve as a professional trader.

There

are two good examples that can be illustrated for you to

understand simple rule of risk and reward.

Let us say you have $10,000 in your trading account, and your stop loss is 15 pips and your reward ratio is twice more than your stop loss at 30 pips or more.

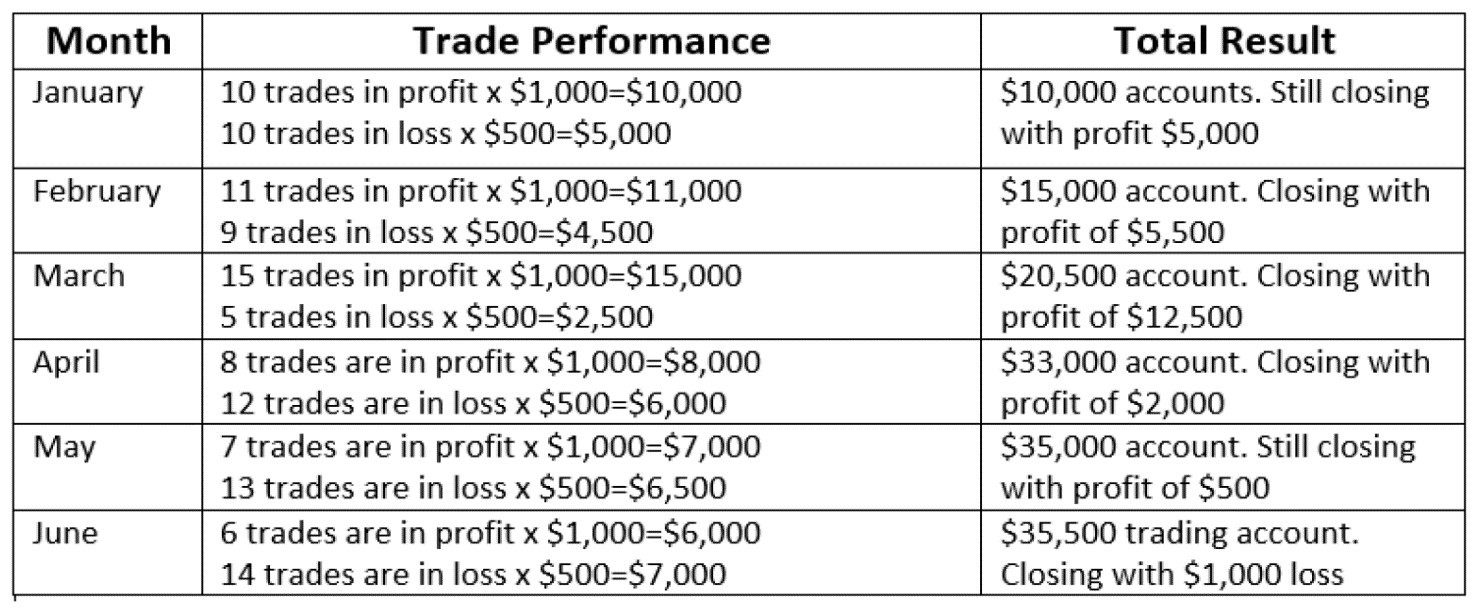

Thus, imagine you placed in this month 20 trades and out of 10 trades are successful and 10 trades are unsuccessful. Power of risk and reward ratio comes here.

Your risk is 5% and every time you lose only $500 and every time your win should be more than $1,000 otherwise you don’t have to take the trades thus only 20 trades are placed.

Overall, taking very strict rule and art of compounding, having single techniques in trading and 5% risk could lead you to such a great success. All it takes you is to get started big path in financial market. 6-month time, despite your loosing trades are more than winning trades you still close with profit, such an opportunity to apply with peace of mind.

Emotions affect a trader’s state of mind, if a person lets an emotion to get better of the person, his/her trading live account can be severely damaged. Some of those emotions include fear, hope and greed.

Fear is very real emotion in trading and in fact two specific fears are:

When we made a wrong decision is when the market hits stop loss and that is when everyone starts saying it was wrong decision. Thus, this leads to the emotion of being feared in entering a trade again, having bad thoughts of losing money again or entering more to cover losses on the same day to purposely get back money through doubling the entry positions.

Therefore, the best solution in overcoming fear, greed and hope is to have a developing personalized trading plan that will be extremely useful tool to help you focus on planning and executing your entire trading strategy.

Writing a trading plan is an integral part of being successful trader. The purpose of trading plan is to help you stick to the rules so that you won’t be swayed by your emotions. Without a trading plan in place, you will be more susceptible to making trading mistakes, overtrading or making impulsive decisions in volatile markets.

Remember that professional traders see profits in two and losses in two also. When it comes to trading the FX, we will encounter emotions. Trading is not a get-rich quick scheme, get the right mind-set. Trading can be gambling as well, but professional traders take it as an investment/business. In trading, it’s about pips and not money.

DOUBT: be ready for the learning curve and learn to trust your own judgment; know that there is no only one way to see the market.

FEAR: a loss is only a loss when the trade is closed in red, traders experience pending/potential losses. A profit also is only a profit when the trade is closed in bleu, traders experience pending/potential profits.

REVENGE: you should know that some trades go straight to the SL and it is normal in trading, stay disciplined.

GREAD: it is experienced both in profits and losses. Respect the levels you must place your SL/TP.

Do not over lot size and review your trades when the market is closed. A trader needs to have routines, discipline, and time management.

While trading plan helps you to plan your trade and follow it with strict rules, a trading journal helps you to track your performance and thoughts over time. Many aspiring traders get caught up in the results of each individual trade, however in the world of professional trading, performance is calculated over a long list of trades. This is important since it helps you to concentrate on the long term and remove any emotion you might attach to any one trade. Trading journal should have the following key areas:

o

Space to place your chart

o

The date of the trade

o

The

strategy employed

o

Entry price

o

Profit target

o

Stop loss

o

Result of the trade

o

Post trade thoughts

Trading journal does not require to be complex instead it could be simple applied through Excel Sheet. Emotions influence on our thoughts and thoughts influence on our emotions, most traders face failure to a successful phase not because of lack of good strategy or poor money management skills, rather sometimes they fail because their thoughts and emotions get the better of them while trading. Whether you are beginner or an advanced trader, this is the best way to keep emotional trading at bay. Commit to doing both for three months, and I guarantee that you will be pleasantly surprised at your trading results at the end of it.

Every morning, I do my technical analysis to identify the trends of my favourite pairs with high time frames like D1 and H4 (I keep adjusting the support/resistance lines throughout the day). I do it emotionlessly with my trading script which indicates the main direction for me. All I have to do is to look for patterns on lower time frames to ride the trend.

Congratulations! You have completed all the

four chapters offered by Mr. Roix! Now it is your time to be a

Forex Trader! I

wish y'all the best and never ever give up! It's a tough journey!

Please,

do not forget to

trade on demo first!

© 2024 ETS ROIX. All rights reserved.