ROIX

FOREX - RISK OVER REGRET

ROIX

FOREX - RISK OVER REGRET ROIX

FOREX - RISK OVER REGRET

ROIX

FOREX - RISK OVER REGRET

1.0 TYPES OF MARKET ANALYSIS

1.1 FUNDAMENTAL ANALYSIS

1.2 SENTIMENTAL ANALYSIS

1.3 TECHNICAL ANALYSIS

2.0 TYPES OF TRENDS

2.1 UPTREND

2.2 DOWNTREND

2.3 RANGE (SUPPORT AND RESISTANCE)

3.0 FUNDAMENTAL FACTORS

3.1 INFLATION

3.2 EMPLOYMENT

3.3 RETAIL SALES

3.4 ISM/PMI REPORTS

3.5 BUSINESS AND CONSUMER CONFIDENCE

3.6 HOUSING DATA

3.7 GROSS DOMESTIC PRODUCT (GDP)

3.8 INTEREST RATE

3.9 TRADE BALANCE

In

fast-emerging global financial market, to make consistent income, and

to become

a professional trader, it is essential to understand types of market

analysis

and it volatility in the first place.

There are three basic types of Market analysis: Fundamental, Sentimental and Technical.

If you like analysing social, economic, and political factors that affect supply and demand, fundamental analysis is for you! As a new trader, you may look at the economic calendar every morning before you start trading. There are news that move the market and some do not move the market. You may observe your chart when a new is released to see how it works. Nowadays, if you click on the detail of the news, you will nd an explanation of the new and how to interpret it. U.S. news affect the pairs with the USD. European countries’ news have an impact on the pairs with the EUR. Japanese news have an impact on the pairs with JPY. Canadian news have an impact on the pairs with CAD. And so on with all others countries. In the chapter three, I will explain how to trade the news with RSI indicator.

Sometimes it is not about the numbers, but how you feel, how do you figure out and trade Forex off of that? I recommend you to read books about how to control your emotions, Psychology of Traders, and other books of Mind-set. It will help you! But me I do not like to read, so I subscribe to podcasts and play it.

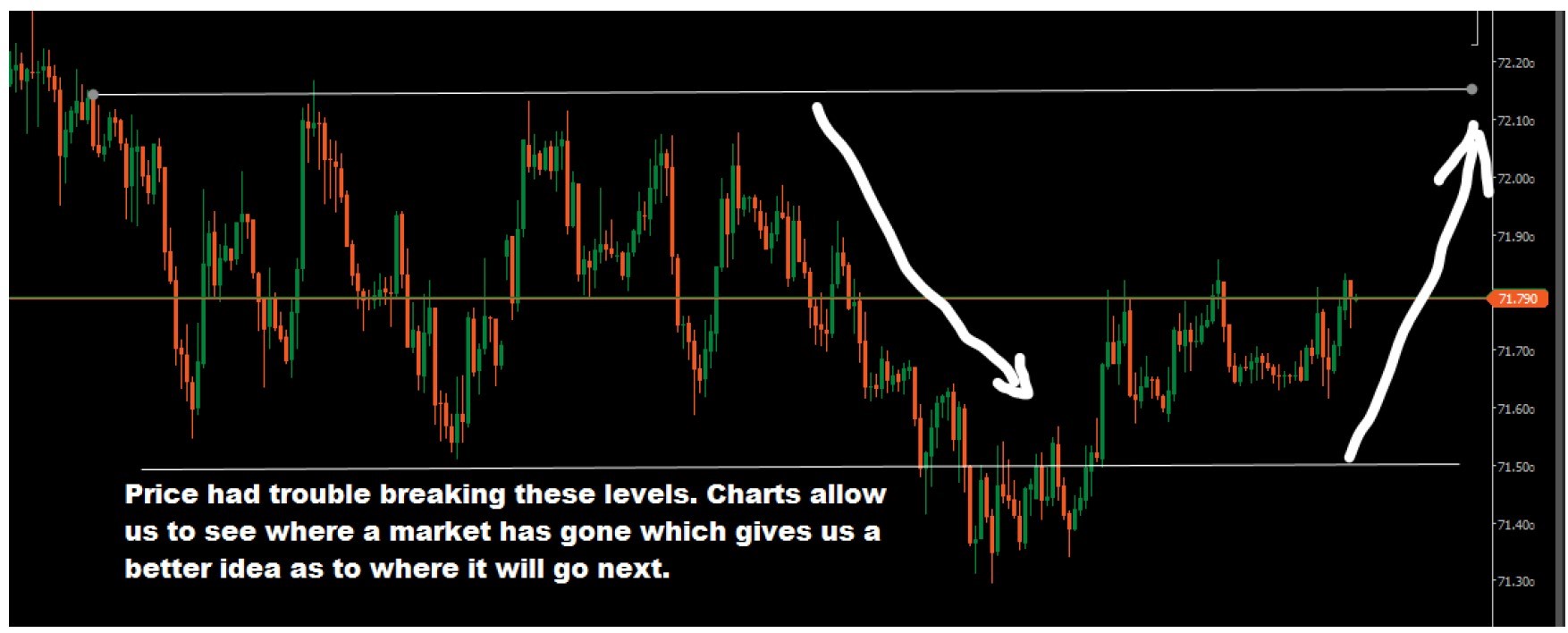

Technical Analysis is the framework in which traders study price movement. To have full comprehension in trading financial market, it is important to start with Technical analysis. The theory is that a person can look at historical price movement and determine the current trading conditions and potential price movement. The main evidence for using technical analysis is that, theoretically, all current market information is reflected in price. If price reflects all the information that is out there, then price action is all one would really need to make trade.

Now, have you ever heard the saying, “History tends to repeat itself ” ? Well, that is basically what technical analysis is all about! If the price level held as a key support or resistance in the past, traders will keep an eye out for it and base their trades around that historical price level.

Technical analysts look for similar patterns that have formed in the past, and will form trade ideas believing that price will act the same way that it did before.

In the world of currency trading, when someone says technical analysis, the first thing that comes to mind is a chart. Technical analysts use charts because they are the easiest way to visualize historical data! You can look at past data to help you spot trends and patterns which could help you find some great trading opportunities.

What’s more is that with all the traders who rely on technical analysis out there, these price patterns and indicator signals tend to become self-fulfilling. As more and more Forex Traders look for certain price levels and chart patterns, the more likely that these patterns will manifest themselves in the markets.

NB: DO NOT USE LOW TIME FRAMES TO DO YOUR TECHNICAL ANALYSIS. EACH MORNING USE D1 AND H4 TO DRAW YOUR LINES AND THEN USE H1 AND M30 TO LOOK FOR ENTRY POINTS.

There are two basic sorts of opportunity to make profit from trading Financial Market such as:

Trend: trend is usually categorized into two, Uptrend and Downtrend.

Range:

Support

and Resistance Lines.

Uptrend is identified as prices having a series of Higher Highs and Higher Lows. The highs are the peaks that prices reach irregularly. Lows are the valleys that prices fall to before heading up again. Thus, an uptrend is formed when there is a series of Highs going higher and a series of Lows going higher. The figure below shows an example of price movement in uptrend.

Downtrend has prices moving in a series of lower highs and lows, the figure below shows an example of a chart moving in a downtrend.

Traders use a trending strategy when the market is moving in an Uptrend or a Downtrend. When the market is in an Uptrend, we would place long position at the Higher Lows and when the market is moving in downtrend, we would place a short position at the Lower Highs.

WHY SHOULD I DRAW TREND LINES?

Trend lines are

lines that are drawn to show prevailing direction of prices. They are

visual

indication to provide us insight into where prices could go next. In an

Uptrend,

it is easy to summarize that prices could increase because there are

more

buyers than sellers. But this is not real case. In the financial

market,

trading Foreign Exchange, the number of contracts bought always equals

the

number of contracts sold.

For example, if

you want to buy 5 lots of USD/JPY currency, the contract must be

available from

someone who wants to sell it. Thus, the number of long and short

positions in

the financial market is always equal.

The

reason lies in the intensity of emotions between the buyers and the

sellers. In

an uptrend, the buyers are in control because they are willing to pay

higher

price. They buy high because they expect prices to rise even higher.

Sellers

are nervous in an uptrend and they agree to sell only at higher

price.The

price moves up because the intensity of buyers’ greed overpowers the

fear and

anxiety of the sellers. The uptrend starts to fail only when buyers

refuses to

buy at higher prices.

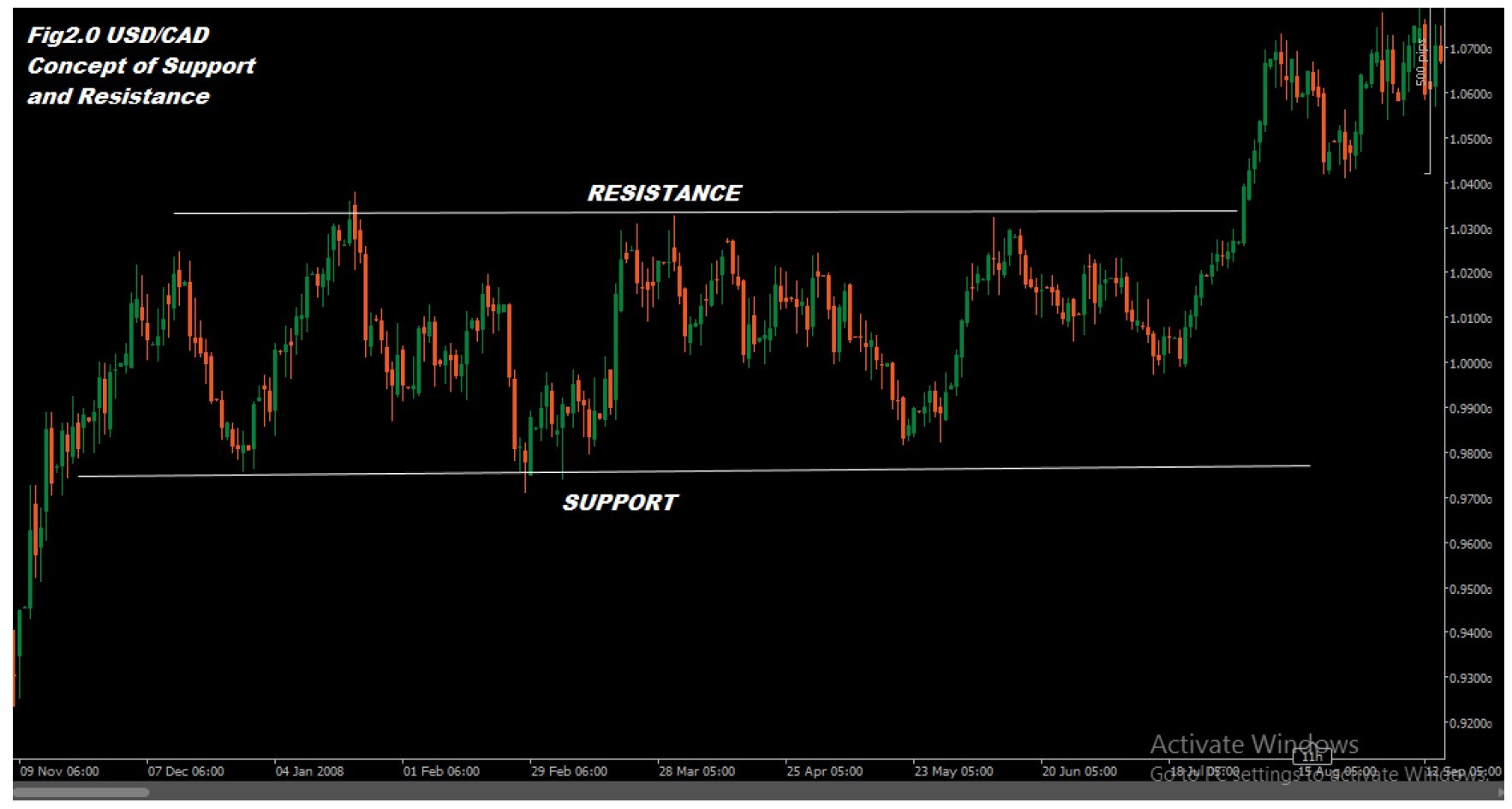

The bottom and the top of trade channels are named as Support and Resistance correspondingly. Resistance is a level at which the selling pressure exceeds the purchasing pressure. Support is a level at which the purchasing pressure exceeds to the selling pressure.

The

more prices bounce off the support and resistance, the stronger these

levels

become. But these levels will be broken through sooner or later, once a

strong

support is broken, that level is likely to turn into a strong

resistance. It is

important for the trader to consider these levels of conversion as it

can

assist in finding best zones to place your stop loss or profit target.

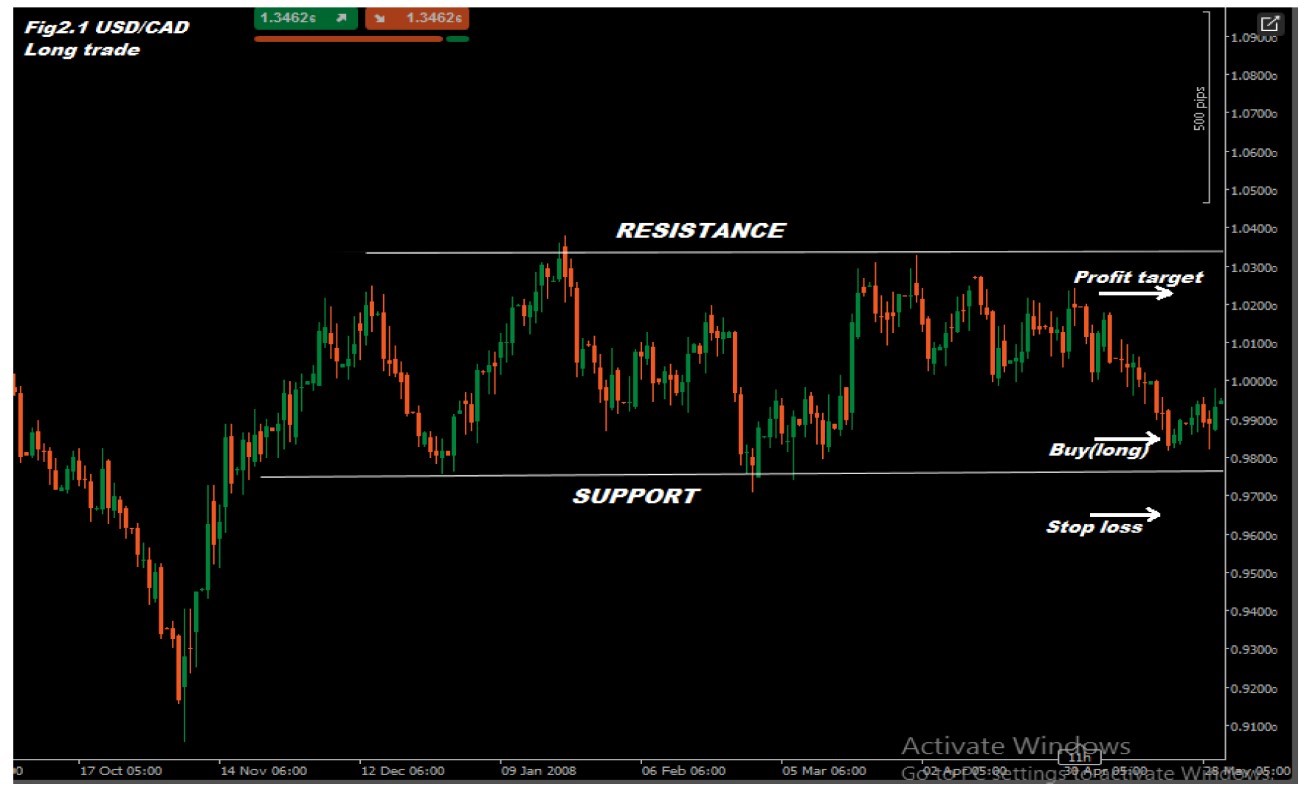

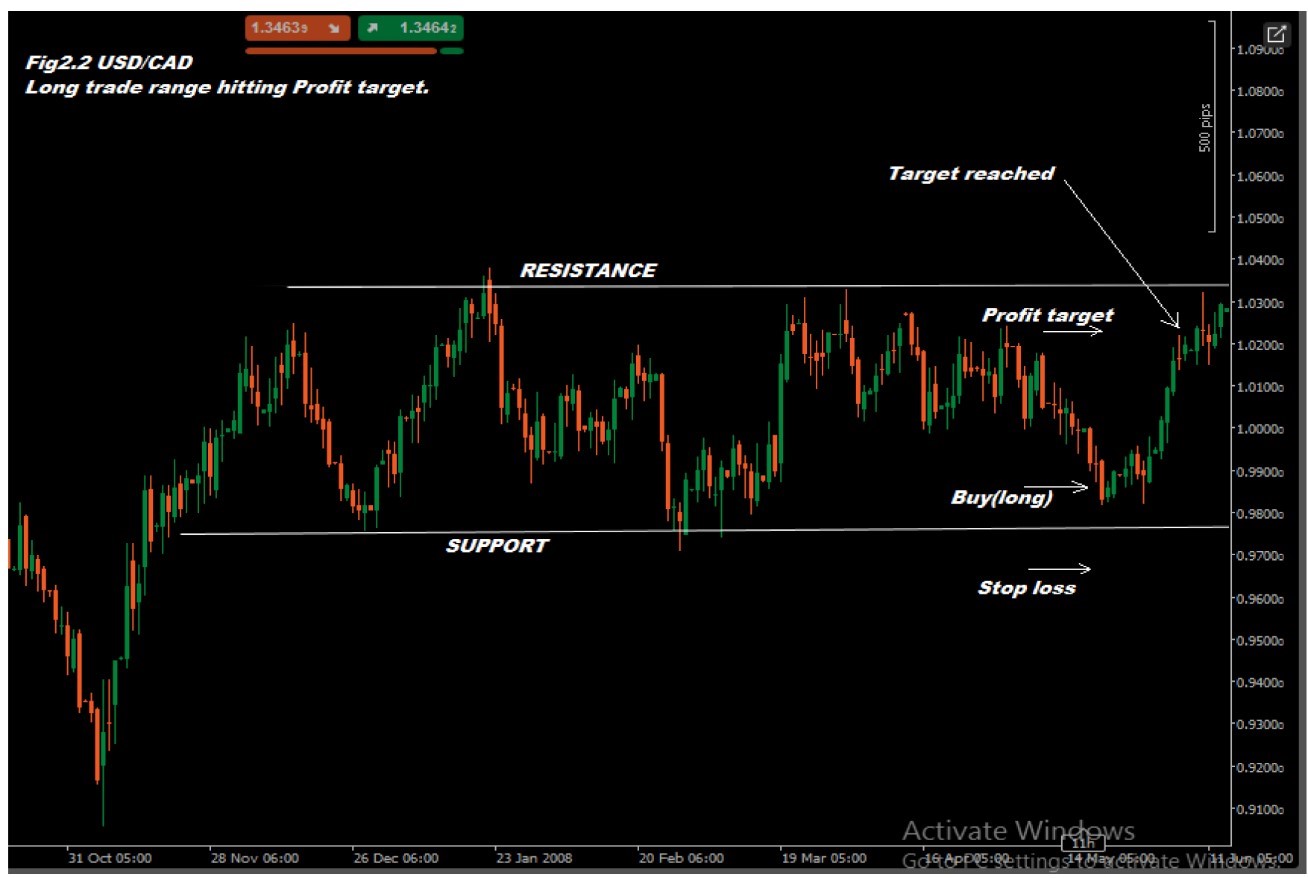

The

figure below shows an example of a ranging chart.

HOW DO I TRADE A SUPPORT AND RESISTANCE?

In order to

place best entries and exits through support and resistance, it is

important to

spot the start and end of support and resistance zones.

Long trade is

placed when a bull candle bounces of support level and closes above the

support

level. Then it is good to place a stop loss below the bottom of the

support

level as it is expected that chances of prices fall below that level is

unlikely. The take profit target may be placed about 80% of the range

measured

from the support level. It means that if the distance between support

and

resistance is 100 pips, the profit target is placed 80 pips away from

the

support. The risk and reward ratio is taken 1:1.

Thus the

distance between the entry price and the profit target is 50 pips, stop

loss

should be 50 pips from the entry price. Likewise, if the distance

between the

entry price of long position and target profit is 100 pips, the stop

loss

should be 100 pips from the entry of long position.

The

main purpose of exiting before the price reaches the top of the range

is

because the resistance level is easily spotted by both retail and

institutional traders alike. It pays to exit earlier since it is not

known how the price will

react once it reaches the resistance level.

Short trade is placed when a bear candle bounces of the resistance level and closes below the resistance level. Then it is good to place a stop loss above the top of the resistance level as it is expected that chances of prices rise above that level is unlikely. The take profit target may be placed about 80% of the range measured from the resistance level. It means that if the distance between support and resistance is 100 pips, the profit target is placed 80 pips away from the resistance. The risk and reward ratio is taken 1:1.

Thus the distance between the entry price and profit target is 50 pips, stop loss should be 50 pips from the entry price. Likewise, if the distance between the entry price of the short position and target profit is 100 pips, the stop loss should be 100 pips from the entry of long position.

The main purpose of exiting before the price reaches the bottom of the range is because the support level is easily spotted by both retail and institutional traders alike. It pays to exit earlier since it is not known how the price will react once it reaches the support level.

That’s just an example, your target profit and stop loss may be placed according to what the market will show you when you start trading.

Those trading

in the Foreign Exchange Market (Forex) rely on the same two basic forms

of

analysis that are used in the Stock Market: Fundamental Analysis and

Technical

Analysis. The uses of technical analysis in Forex are much the same:

price is

assumed to reflect all news, and the charts are the objects of analysis.

But unlike

companies, countries have no balance sheets, so how can fundamental

analysis be

conducted on a currency?

Since

fundamental analysis is about looking at the intrinsic value of an

investment,

its application in Forex entails looking at the economic conditions

that affect

the valuation of a nation’s currency. Here we look at some of the major

fundamental factors that play a role in a currency’s movement.

Economic Indicators:

Economic

indicators are reports released by the government or a private

organization

that detail a country’s economic performance. Economic reports are the

means by

which a country’s economic health is directly measured, but remember

that a

great deal of factors and policies will affect a nation’s economic

performance.

So, how are they used?

Since

economic indicators gauge a country’s economic state, changes in the

conditions

reported will therefore directly affect the price and volume of a

country’s

currency. It is important to keep in mind, however, that the indicators

discussed above are not the only things that affect a currency’s price.

Third-party reports, technical factors and many other things also can

drastically affect a currency’s valuation.

Understanding inflation is crucial in forex trading, particularly in the context of fundamental analysis. Inflation, the rise in the general price level of goods and services, significantly influences currency values and exchange rates. Traders closely monitor central bank policies, as interest rate decisions play a key role in controlling inflation and impacting currency strength. Countries with lower inflation rates generally see their currencies appreciate compared to those with higher inflation. Forex traders analyse economic indicators such as the consumer price index (CPI) and producer price index (PPI) to gauge inflationary pressures. Inflation differentials between currencies, nominal vs. real interest rates, and the impact of inflation on consumer spending are all critical factors considered in fundamental analysis. Additionally, traders assess the influence of inflation on commodity prices, global economic conditions, and overall market expectations to make informed decisions about potential currency movements in the dynamic forex market.

Non-Farm

Payrolls (NFP) are the name given to the data that pertains to the

number of

people who are employed within the US economy, and it is released the

first

Friday of every month by the Bureau of Labour Statistics. Strong

decreases in

employment indicate a contracting economy, while strong increases are

perceived

indicators of a prosperous economy.

Every

first Friday of a new month please observe USD/JPY during the NFP

releasing to

see the movement (if the month starts on a Friday, then it happens on

the next

Friday. The time of release will be seen on the economic calendar). In

chapter

three I will explain how to trade economic news.

The

retail-sales report measures the total receipts of all retail stores in

a given

country. This measurement is derived from a diverse sample of retail

stores

throughout a nation. The report is particularly useful as a timely

indicator of

broad consumer spending patterns that is adjusted for seasonal

variables. It

can be used to predict the performance of more important lagging

indicators,

and to assess the immediate direction of an economy.

Revisions

to advanced reports of retail sales can cause significant volatility.

The

retail sales report can be compared to the sales activity of a publicly

traded

company.

Industrial

Production: this report change in the production of factories, mines

and

utilities within a nation. It also reports their “capacity

utilizations”, the

degree to which each factory’s capacity is being used. It is the deal

for a

nation to see a production increase while being at its maximum or near

maximum capacity utilization.

Traders

using this indicator are usually concerned with utility production,

which can

be extremely volatile since the utilities industry, and in turn trading

of and

demand for energy, is heavily affected by changes in weather.

Significant

revisions between reports can be caused by weather changes, which in

turn can

cause volatility in the nation’s currency.

Consumer Price Index (CPI): the CPI measures change in the prices of consumer goods across over 200 different categories. This report, when compared to a nation’s exports, can be used to see if a country is making or losing money on its products and services.

Be careful, however, to monitor the exports, it is a popular focus with many traders, because the prices of exports often change relative to a currency’s strength or weakness.

The Existing

Home Sales Report is a monthly release covering the number of existing

homes

that were closed during the survey month along with average sales

prices by

geographic region. The “closed” distinction is important because most

closing

periods are anywhere from six to eight weeks, so values listed are

likely to

relate to sales made about two months prior. The data is collected and

released

by the National Association of Realtors.

There are three

important metrics in this report; in addition to the aggregate number

of

existing homes sold and median selling prices, inventory levels are

provided

through the “months” supply figure, a number that represents the length

of time

in months required to burn through all of the existing inventory

measured

during the period.

Data

is provided raw and with seasonal adjustments. This is because weather

is a big

factor in determining month-to-month demand. As with the Housing Starts

Report,

the data is also broken down by geographic region (Northeast, Midwest,

South

and West). Price data will show percentage changes from the

year-over-year

period and the prior month.

GDP is

considered the broadest measure of a country’s economy, and it

represents the

total market value of all goods and services produced in a country

during a

given year. Since the GDP figure itself is often considered a lagging

indicator, most traders focus on the two reports that are issued in the

months

before the final GDP figures: the advance report and the preliminary

report.

Significant revisions between these reports can cause considerable

volatility.

The

GDP is somewhat analogous to the gross profit margin of a publicly

traded

company in that they are both measures of internal growth.

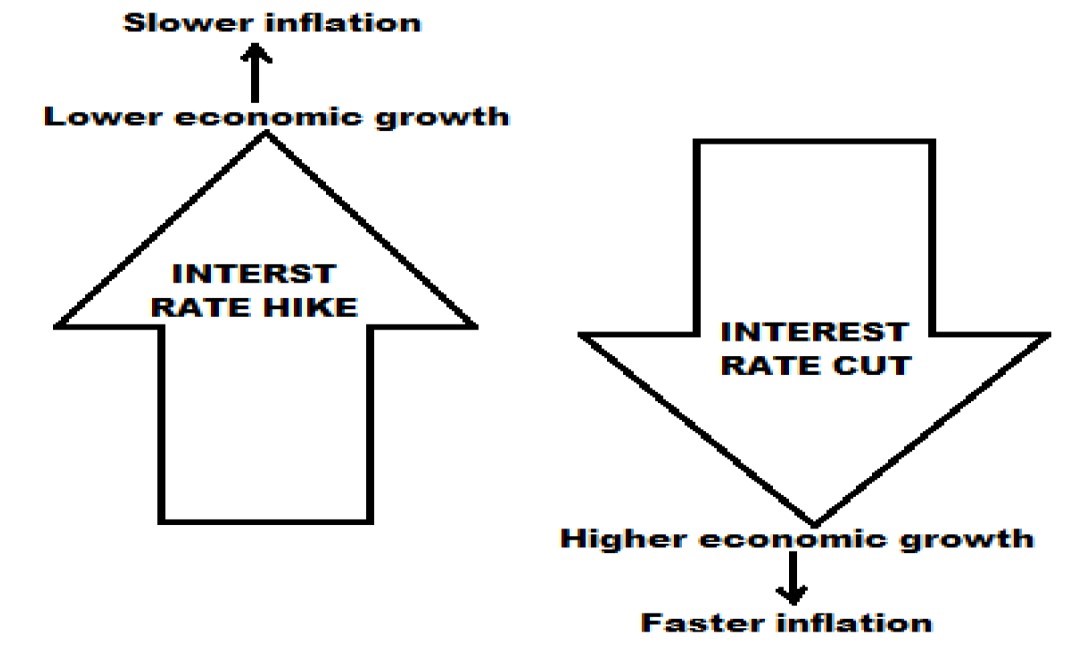

The higher

Interest Rates that can be earned tend to attract foreign investment,

increasing the demand for and value of the home country’s currency.

Conversely,

lower interest rates tend to be unattractive for foreign investment and

decrease the currency’s relative value. Simply put, interest rates make

the

Forex world go ’round!

In other

worlds, the Forex Market is ruled by interest rates. A currency’s

interest rate

is probably the biggest factor in determining the perceived value of a

currency. So, knowing how a country’s central bank sets its monetary

policy,

such as interest rate decisions, is a crucial thing to wrap your head

around.

One of the biggest influences on a central

bank’s interest rate decision is price stability, or “Inflation”.

Inflation is a

steady increase in the prices of goods and services.

Inflation is the reason

why your parents or your parents’ parents paid a nickel for a soda pop

in the 1920’s, but now people pay

twenty times more for the same product.

It’s generally accepted

that moderate inflation comes with economic growth.

However,

too much inflation can harm an economy and that’s why central banks are

always

keeping a watchful eye on inflation-related economic indicators, such

as the

CPI and PCE.

Trade

balance measures the ratio of exports to imports for a given

country’s economy. If exports are higher than imports (a trade

surplus), the

trade balance will be positive. If the imports are higher than exports

(a trade

deficit), the trade balance will be negative.

Knowing

the exchange rate is obviously critical for any foreign exchange

trader, but information on the net exports in a country can help to

predict

future trends in inflation and foreign investment, and thus can give

clues to

the future behaviour of any given currency market.

Trade

balance is derived primarily from three factors: The price of

goods in a country; Tax and tariff levies on imported or exported

goods; and

the exchange rate between two currencies.

This

last factor is fundamental to foreign exchange trading. Since the

trade balance depends so heavily on the current state of exchange rates

between

two countries, trade balance is a key coincident indicator for the

state of a

foreign exchange asset market.

There

are a number of measures for trade balance, but one of the chief

sources of information on the state of trade in the US is the

International

Trade report released monthly by the Cenus Bureau and the Bureau of

Economic

Analysis.

This

report is released around the third week of every month and details

the performance of several exported goods and services in various

sectors of

the economy.

Congratulations! You have completed the chapter two.

© 2024 ETS ROIX. All rights reserved.