ROIX

FOREX - RISK OVER REGRET

ROIX

FOREX - RISK OVER REGRET ROIX

FOREX - RISK OVER REGRET

ROIX

FOREX - RISK OVER REGRET

The global financial market has been revolutionized much

by the years.

Its initial phase of financial crisis has started since 2007, which was

when

the value of sub-prime mortgages lead to a liquidity crisis. Banks went

through

a credit crunch and loans has reached an end.

The US 5th largest investment bank, Bear Stearns during the time

collapsed and sold to JP Morgan in 2008, the chips fell dramatically.

During the financial market collapse, there were many events fall

significantly including the Bank of America announcement on buying

Merril Lynch

in all stock deal worth USD50 billion and Lethman Brothers filed for

bankruptcy, Federal Reserve announcement on emergency loan to the tune

of USD85

billion to save AIG Insurance Company, also the Dow plunged to 777.68

points-

its largest drop, 7% in a day in the history. Such historical events

occurred

within just two-week’ time.

Before the global financial market sufficiently recover from the

crisis,

Eurozone crisis shocked many. Greece announcement on Greece Bailout of

110

billion euros from the European Commission, European Central Bank and

International Monetary Funds. In the same year, which is in May 2010,

Ireland

turned out to be following victim in November of the same year with a

bailout

deal value in 85 billion euros. Next quarter lead to Portugal, Spain

and Cyprus

demanding financial help.

Where is the opportunity for the retail trader and investor against a

backdrop of uncertain crisis?

The solution on such matter, is

the Foreign Exchange in the financial market.

The bank of international settlements announced that global foreign

exchange volume reached an unparalleled level of 5.3 trillion US

dollars a day,

making Foreign Exchange the largest financial market in the world in

2013.

Even though unprecedented opportunities for the retail trader, very few

make consistent profits out of it. This is because not many traders are

equipped with adequate trading tools and materials to gain this skill.

Currencies are important to most people around the world, whether

they

realised it or not, because currencies need to be exchanged to conduct

foreign

trade and business. If you are living in the U.S. and want to buy

cheese from

France, either you or the company that you buy the cheese from has to

pay the

French for the cheese in euros (EUR). This means that the U.S. importer

would

have to exchange the equivalent value of U.S. dollars (USD) into euros.

The

same goes for traveling. A French tourist in Egypt cannot pay in euro

to see

the pyramids because it is not the locally accepted currency. As such,

the

tourist has to exchange the euros for local currency, in this case the

Egyptian

pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and half days a week, and currencies are traded worldwide in the major financial centres of London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris and Sydney – across almost every time zone. This means that when the trading day in the U.S. ends, the Forex market begins anew in Tokyo and Hong Kong. As such, the Forex market can be extremely active any time of the day, with the price quotes changing constantly.

There are actually three ways that institutions,

corporations and

individuals trade Forex: the spot market, the forwards markets and the

futures

market. The Forex trading in the spot market always has been the

largest market

because it is the “underlying” real asset that the forwards and futures

markets

are based on. In the past, the futures market was the most popular

venue for

traders because it was available to individual investors for a longer

period of

time.

However, with the advent of electronic trading, the spot market has

witnessed a huge surge in activity and now surpasses the futures market

as the

preferred trading market for individual investors and speculators. When

people

refer to the Forex market, they usually are referring to the spot

market. The

forwards and futures markets tend to be more popular with companies

that need

to hedge their foreign exchange risks out to a specific date in the

future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, reflects many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a “spot deal”. It is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specific amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and in a future date for settlement. In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves. In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange. In the U.S., the National Futures Association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement. Both types of contracts are binding and are typically settled for cash for the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well. (For more in-depth intro to futures, please google it).

NB: Note that you will see the terms: FX, Forex, Foreign-Exchange market and currency market. These terms are synonymous and all refer to the Forex Market.

However, to appreciate its

size, let’s describe in two different ways:

NYSE (New York Stock Exchange) group, which is the world’s largest venue for trading stocks, trades in excess of 30 billion US dollars a day. The Forex Market trades 5.3 trillion US dollars a day. This is about 176 times the size of NYSE group.

Imagine that you were paid of $1,000 every second. In one minute, you would be paid $60,000. In 2 minutes, $120,000. In one day, you would be paid $86,400,000. Now here comes the biggest. How long would it take before you are paid one trillion dollars? The answer is 32 years. In other words, it would take almost 170 years to pay you the equivalent of what the Forex Market trades in one day. That is if you were paid $60,000 every minute. Do you see how enormous the Forex Market is?

This is the place where one currency is exchanged for another, and it has a lot of unique attributes that may come as a surprise for new traders. Here we take an introductory look at the Forex Market and how and why traders are increasingly flocking toward this type of trading.

An exchange rate is the price paid for one currency

in exchange for

another. It is the type of exchange that drives the Forex market.

However, most international Forex trades and payments are made using the U.S. dollar, Japanese yen and euro. Other popular currency trading instruments include the British pound, Australian dollar, Swiss franc, Canadian dollar and Swedish krona.

Currency can be traded through spot transactions, forwards, swaps, and option contracts where the underlying instrument is currency. Currency trading occurs continuously around the world, 24 hours a day, five days a week.

1)

24-HOUR

MARKET

Unlike any other financial market, the Forex market is open 24 hours, 5

days a week. There is no waiting for opening bell. This is deal for

those who

want to trade either part of full time because you can choose whichever

time to

enter the market: whether it is morning, afternoon, evening or in the

wee

hours.

On time scale, the trading action starts at 8am Sydney time on Monday morning all the way to 5pm New York time (GMT-4) on Friday Evening. This insures that you never have to be left out of the market in an event of data release or a breaking news announcement.

2) LOW TRANSACTION COSTS

3)

NO

FIXED LOT SIZE

In the futures markets, lots or contracts sizes are determined by the

exchanges. For instance, the lot size for a copper futures contract on

London

Metal Exchange (LME) is 25 tonnes. The lot size for a Gold futures

Contract on

the Commodity Exchange (COMEX) is 100 troy ounces. In Forex, you

determine your

own lot size. You can trade 0.17 lots, 6.4 lots

or 200 lots, it is up to you.

4)

HIGH

LIQUIDITY

The Forex market has a daily average turnover of $5.3 trillion as the

most heavily traded financial market in the world, it is also the most

liquid.

With so many market participants trading every hour of every day, you

will

always find a ready buyer or seller regardless of transaction size. The

heaviest volumes of trades occur during the European afternoon session

when

there is an overlap of the US session as it starts to enter the market.

This

overlap often attracts a lot of buying and selling from traders.

Exiting a

trade anytime is also easy. You are never stuck in a trade. You can

even set

your online trading platform automatically. The immense liquidity

available in

the Forex market means everyone has an equal chance of making money

whether you

are trading $5,000 or

$10 million.

5) HIGH LEVERAGE

Famed Greek Mathematician Archimedes once said, give me a place to stand and a lever long enough and I will move the entire world. Archimedes was talking about leverage. Put it simply, leverage means doing more with less. In forex you can utilize leverage to control a relatively larger contract value with a small deposit. Leverage gives the trader the ability to make good profits while at the same time keeping the risk capital to a minimum. For instance, if you trade with a 100:1 leverage, it means that a $1,000 deposit would enable you to buy or sell $100,000 worth of currencies. This is also called a margin of 1 percent, since $1,000 is 1 percent of the contract size of $100,000. As a comparison, traders in the futures market must post margin equal to between5-8 percent of the contract value while stock traders typically must post at least 50 percent margin.

6) MARKET TRANSPARENCY

When governments, central banks chiefs, or finance ministers make economic monetary policies that affect currencies, the announcements are readily available on almost every media imaginable within few minutes. The bonus is that in most cases, warning signals or hints about future actions are dropped in advance. Here is an example: on 4th of August 2011, the Bank of Japan sold 4,5 trillion yen to weaken its currency, this caused the USD/JPY to shoot up 300pips, selling a record 8 trillion yen, this move caused the yen to plunge more than 4 percent and caused the USD/JPY to shoot up over 350pips in just 3 hours.

7) TOTAL CONVENIENCE

All you need to get started in trading Forex is two things: a laptop and internet connection. It does not matter if you prefer the pulse of Wall Street or the balmy in Bali. In fact, with the latest innovations in technology you can be plugged into the market from your favourite mobile device, including smart phones or tablets. This convenience allows you to access the prices and charts at your fingertips without missing another trade again.

8) STARTING SMALL

Brokers today offer minimum account deposit of only $100. Some other account types are even lower. This makes the Forex much more accessible to the average individual who does not have a lot of start-up capital. The low minimum deposit is a big factor which draws in new traders. Additionally, brokers offer mini and micro trading accounts. A mini account allows you to trade position sizes as small as 10 cents per pip movement. A micro account allows you to trade position sizes as small as 1 cent per 1 pip movement. This allows you to effectively control your risk even if you are not starting with much money. That is why ROIX FOREX is given you FREE Forex Education. (Save your money for start-up).

9) PROFITING FROM BULL/BEAR MARKET

In Wall Street, Language a bull market is a market that is heading up and bear market is one that is heading down. Compared to the stock market, the Forex market has no structural bias. For example, most stock markets have a bullish bias. This means traders tend to like the long side or upside of the market more. If you were looking at a stock that you believed was a good investment, you would buy the stock. In most countries ability to short a stock or a commodity is either no-existent or has severe limitations. In Forex, it is equally easy to buy or sell at any time and there is never nay increased fee for selling short. This is because in any trade, you are buying a currency and simultaneously selling another. If you go long (buy) on USD/JPY, you are selling yen and buying dollars at the same time. The ability to buy or sell at any time with no penalties is a huge advantage that Forex has over other Markets.

10) FREE ACCOUNTS, TOOLS AND SOFTWARE

Most online Forex brokers offer demo accounts to practice trading, along with breaking Forex news and charting service. All free. A demo account means 2 things: you trade with fake money but prices are live. These are very valuable resources for traders who would like to hone their trading skills with play money before opening a live trading account. And now, Xulzay Roix offers FREE Forex Education that worth more than $1,000. It is an opportunity for new traders to start trading with all the necessary knowledge and skills to start.

11) RECESSION-PROOF

There are not many recession-proof businesses out there. Here are few:

•

Sweepstakes/Lottery

•

Hospitals

• Funeral Parlours

The Forex Market is considered recession-proof simply because it is not susceptible to market cycles.

Businesses have cycles, stock markets have cycles and property markets have cycles too. In Forex, simply because we trade in currency pairs, there is always an opportunity for one currency to strengthen over another. In another word, there is never a bad time to trade the Forex Market.

12) EARN BIG with Prop Trading Firms

If the counter currency is the US dollar, 1 pip is always worth of USD10 per Lot. Get funded up to 600.000,00 USD with prop trading firms.

There are many players in the Forex Market:

a)

CENTRAL

BANKS

Central banks are extremely important players in Forex Market. Open

market operations and interest rate policies of central banks influence

currency rates to a very large extent. Central banks are responsible

for Forex

fixing.

This is the exchange rate regime by which a currency will trade in the

open market. Floating, fixed and pegged are the types of exchange rate

regimes.

Any action taken by a central bank in Forex market is done to stabilize

or

increase the competitiveness of that nation’s economy. Central banks

(as well

as governments and speculators) may engage in currency interventions to

make

their currencies appreciate or depreciate. During periods of long

deflationary

trends, for example, a central bank may weaken its own currency by

creating

additional supply, which is then used to purchase a foreign currency.

This

effectively weakens the domestic currency, making exports more

competitive in

global market. (Central banks use these strategies to calm inflation,

but they

can also provide longer-term clues for Forex traders. For more details,

please

google how inflation-fighting techniques affect the currency market).

b)

INVESTMENT

MANAGER AND HEDGE FUNDS

After banks, portfolio managers, pooled funds and hedge funds make up

the second-biggest collection of players in Forex Market. Investment

managers

trade currencies for large accounts such as pension funds and

endowments. An

investment manager with an international portfolio will have to

purchase and

sell currencies to trade foreign securities. Investment managers may

also make

speculative Forex trades.

Hedge funds execute speculative currency trades as well.

c)

CORPORATIONS

Firms engaged in importing and exporting conduct forex transactions to

pay for goods and services. Consider the example of a German solar

panel

producer that imports American components and sells the final goods in

China.

After the final sale is made, the Chinese yuan must be converted back

to euros.

The German firm must exchange euros for dollars to purchase the

American

components. Companies trade Forex to hedge the risk associated with

foreign

currency translations. The same German firm might purchase American

dollars in

the spot market, or enter into a currency swap agreement to obtain

dollars in

advance of purchasing components from the American company in order to

reduce

foreign currency exposure risk. (Hedging against currency risk can add

a level

of safety to your offshore investments. For more, google Protect Your

Foreign

Investments from Currency Risk.)

d)

INDIVIDUAL

INVESTORS

The volume of trades made by retail investors is extremely low compared

to that of banks and other financial institutions. But the Forex trade

is

growing rapidly in popularity. Retail investors base currency trades on

a

combination of fundamentals (interest rate parity, inflation rates,

monetary

policy expectations, etc.) and technical factors (support, resistance,

technical indicators, price patterns).

Clearly,

Forex market participants trade currencies for very different reasons.

Speculative trades executed – by banks, financial institutions, hedge

funds and

individual investors- are profit motivated. Central banks move Forex

markets

dramatically through monetary policy, exchange regime setting, and, in

rare cases, currency intervention. Corporations trade currency for

global business

operations and to hedge risk. (The use of margin to trade in the

Foreign

Exchange Market can magnify profit opportunities. For details, please

google

adding Leverage to Your Forex Trading.

e)

FOREX

TRADERS SHAPE BUSINESS

The resulting collaboration of Forex traders is highly liquid, global

market that impacts business around the world. Exchange rate movements

are a

factor in inflation, global corporate earnings and the balance of

payment

account for each country. When interest rates in higher yielding

countries

begin to fall back towards lower yielding countries, the carry trade

unwinds

and investors sell their higher yielding investments. An unwinding of

the yen

carry trade may cause large Japanese financial institutions and

investors with

sizable foreign holdings to move money back into Japan as the spread

between

foreign yields and domestic yields narrows. This may result in a broad

decrease

in global equity prices.

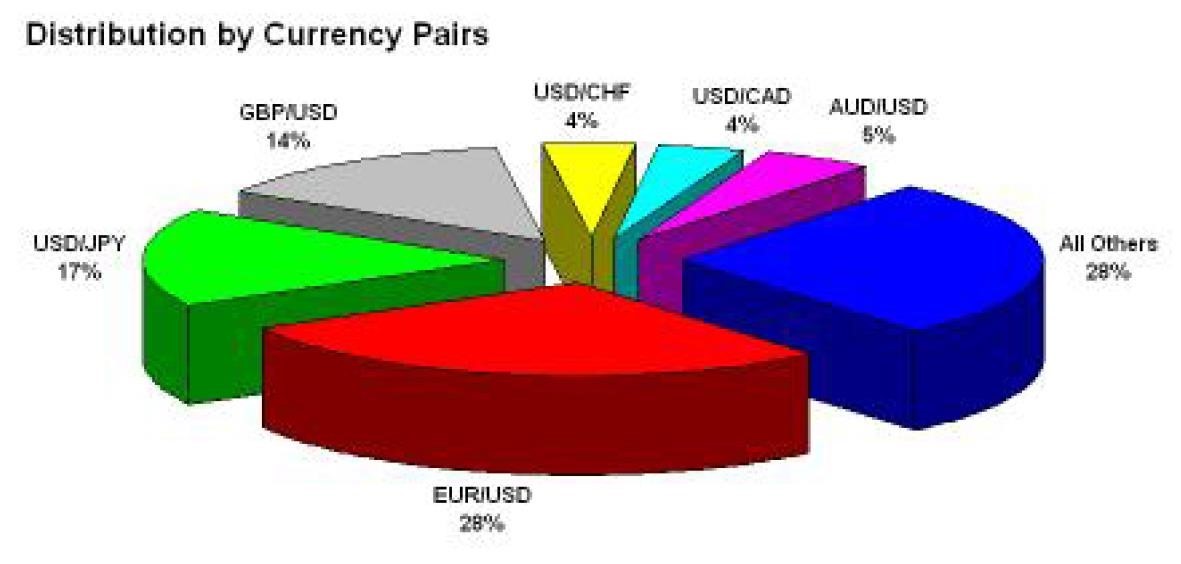

Foreign Exchange, or Forex for short, is a market where one currency is exchanged for another. This is the reason why Forex is quoted in currency pairs. Each world currency is given a three- letter code as set out by the International Standards Organization (ISO) and governed by the ISO 4217. The eight most commonly traded currencies are: USD (U.S. dollar), EUR (euro), GBP (Great Britain Pound), AUD (Australian dollar), JPY (Japanese yen), CHF (Swiss franc), CAD (Canadian dollar) and NZD (New Zealand dollar). The eight most commonly traded currencies form the seven major currency pairs. These seven majors dominate the Forex market in terms of traded volume. Since January 2012, it is estimated that the seven majors account for over 85% of the daily traded volume in the Forex Market. These seven major currency pairs are: EUR/USD: euro versus U.S. dollar; USD/JPY; GBP/USD; AUD/USD; USD/CHF; USD/CAD and USD/NZD. This figure shows how much volume is contributed by the seven majors. It also shows that the EUR/USD currency pair contributes the highest percentage of daily traded volume with 28%. FIGURE daily traded volume contributed by the major currency pairs for all the listed seven majors, the U.S. dollar features in either the left-hand side or the right-hand side of the currency pair. Therefore the U.S. dollar is the most liquid currency in the Forex world.

Pips stands for “Price Interest Point”. It is the unit of measurement to express the change in value between two currencies. Let’s say that the current AUD/USD price is 1.0235. If the price rises to 1.0236 or falls to 1.0234, this is a movement of 0.0001, or 1 pip. If the current price of USD/JPY is 81.33, and if the price rises to 81.34 or falls to 81.32, this is a movement of 0.01, or 1 pip. One pip is thus the smallest change in value for any given Forex quote, whether it’s quoted to two or four decimal places. Here are examples: when the EUR/USD quote moves up from 1.3255 to 1.3287, it is a movement of 32 pips.

When the EUR/USD quote moves down from 1.3255 to 1.3138, it is a movement of 117 pips. When the USD/CHF quote moves up from 0.9148 to 0.9263, it is a movement of 115 pips. When the USD/CHF quote moves down from from 0.9148 to 0.9126, it is a movement of 22 pips. When the USD/JPY quote moves up from 80.55 to 80.87, it is a movement of 32 pips. When the USD/JPY quote moves down from 80.55 to 79.788, it is a movement of 77 pips.

Different currencies have different values. Hence, the value of a pip is different for each currency. The first thing to take note of when calculating pip value is that for most Forex quotes, particularly the seven majors, the U.S. dollar is either the base currency or the counter currency. In the USD/CHF quote, the U.S. dollar is the base currency. In the AUD/USD quote, the U.S. dollar is the counter currency.

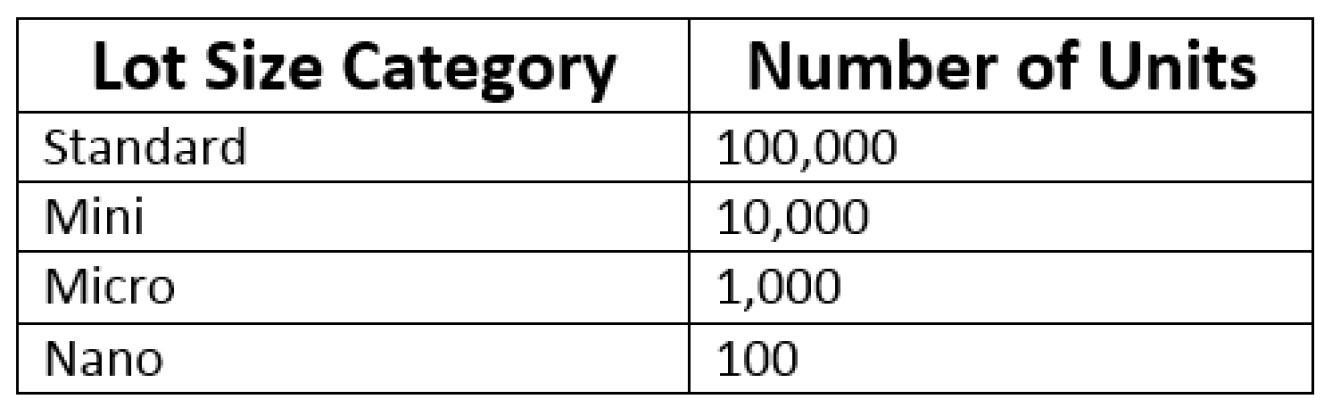

LOT SIZE

Most brokers today provide up to four categories of lot sizes for the trader. These are: Standard lot; Mini lot; Micro lot and Nano lot. A standard lot is dened as 100,000 units of the base currency. For example, when you buy 1 standard lot of EUR/USD, you are purchasing 100,000 euros with U.S. dollar. A mini lot dened as 10,000 units of the base currency. For example, when you buy 1 mini lot of GBP/USD, you are purchasing 10,000 pounds with U.S. dollar. A micro lot is dened as 1,000 units of the base currency. For example, when you buy 1 micro lot of USD/CHF, you are purchasing 1,000 U.S. dollar with Swiss francs. A Nano lot is dened as 100 units of the base currency. For an example, when you buy 1 Nano lot of USD/CAD, you are purchasing 100 U.S. dollars with Canadian dollars. The lot size decreases by a factor of 100 from standard, to mini, to micro, and finally to Nano, as shown in table below:

This chapter starts with an explanation of how currencies are bought or sold in the market. We decode a Forex contract for Long and Short. This part also explains the three critical points in every trade and points out the bid/ask spread that brokers charge for each trade. This part also presents the four reason that cause currencies to fluctuate daily. We then turn to the fraction theory, which helps us to decide on a long (buy) or short (sell) trade. This chapter ends with an explanation of how charts are red and how market structure is identified.

Buy Low/Sell High

Forex traders make money by speculating on the movement of

currency

rates. There are only two ways to do this. The first way is to buy,

expecting

the prices to rise.

The current rate for AUD/USD is now 1.0325. You enter into a buy position because you expect the Australian dollar to strengthen further against the U.S. dollar. A buy trade is termed a “Long position” in the Forex Market. After three hours, the AUD/USD rate is at 1.0375. You were right, and you made 50 pips on this trade. Another way of saying this is that your long position took profit.

The current rate for EUR/USD is at 1.3142. You enter into a sell position because you expect the euro to further weaken against the U.S. dollar. A sell trade is termed “Short position” in the Forex market. After two hours, the EUR/USD rate is at 1.3112. You were right, and you made 30 pips on this trade. Another way of saying this is that your short position took profit.

3 POINTS EVERY TIME YOU PLACE A TRADE TO REMEMBER!

When you execute a position, there are essentially three points in every trade: Entry price, Profit target (Take Profit), and Stop Loss. The entry price is defined as the price at which a trade is triggered. The profit target is defined as the price where the trade exits with a profit. The stop loss is defined as the price where the trade exits with a loss. Let’s use an example for both a long and short position.

LONG POSITION

Let’s take the current GBPUSD price at 1.5743. Because you expect the pound to appreciate against the U.S. dollar, you enter into a long position. You decide to take profit of 30 pips and a stop loss of 30 pips. Once these values are locked down in the broker’s platform, only two things can happen: the trade will hit either the profit target or the stop loss. In this example:

Entry price=1.5743

Stop loss=1.5713

Profit target=1.5773

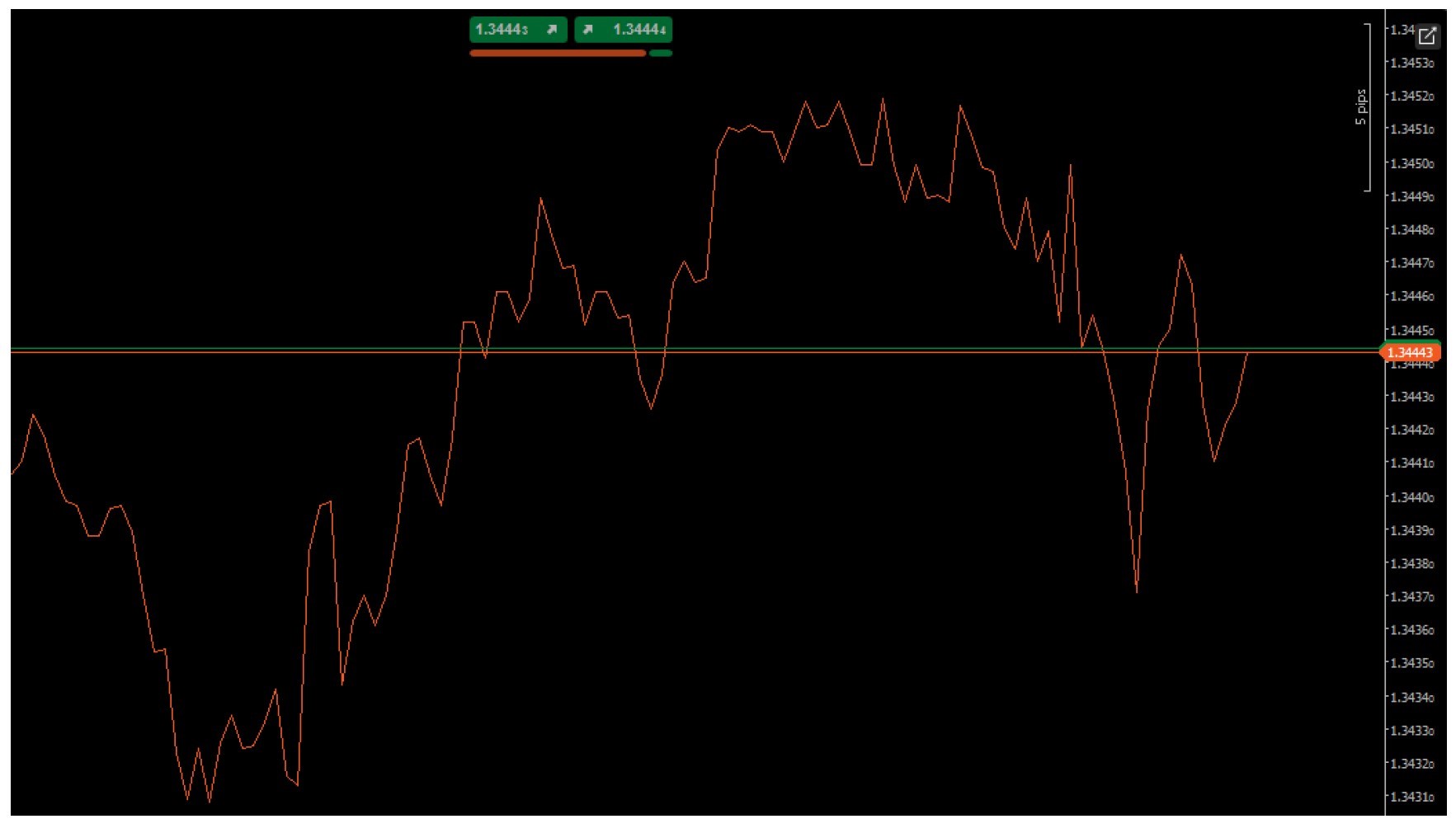

For a long position, the profit target is located above the entry price while the stop loss is located below the entry price. In this example, you take an equal amount of pips for the exit: 30 pips above the entry price and 30 pips below the entry price. Whenever a trade reflects an equal distance between the entry to the profit target and between the entry price and the stop loss, the trade is said to have a risk-to-reward ratio of 1:1. Figures show an actual progression of a long trade that took profit.

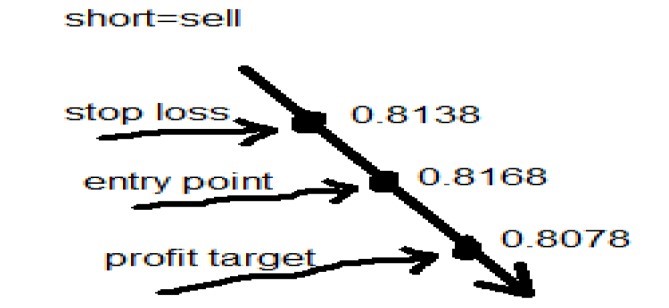

SHORT POSITION

Let’s take the current NZD/USD price as 0.8138. You expect the New Zealand dollar to fall against the U.S. dollar; hence, you enter into a short position. You decide to take a prot of 60 pips and stop loss of 30 pips. Once these values are locked down in the broker’s platform, only two things can happen: the trade will hit either the profit target or the stop loss. In this example:

Entry price=0.8138

Stop loss=0.8168

Profit target=0.8078

For a Short position, the Profit target is located below the entry price while the stop loss is located above the entry price. In this example, you set a 30 pips stop loss but a profit target of 60 pips. This is termed a 1:2 risk to reward ration.

There are three types of charts which traders use on the broker’s platform. The three charts include Line Chart, Bar Chart and Candlestick Chart. In this chapter it just an overview of the candlesticks you will see. In chapter two, it will be more detailed.

The line chart is plotted by connecting the closing prices over a specific time frame. With a simple line, the price trend of a currency can be seen. The line chart is applicable for all currency pairs, across all time frames. As a trader, it is important to select the time frame that you are comfortable with. A short time frame can help you to align yourself with the dominant trend. The simplicity of the line char comes with one glaring drawback: because all the line ever records is the closing price, traders are not able to see any drastic moves prior to the close of the period. Hence, traders are not able to utilize vital market information to aid their decision-making process. Here is a graph presenting a line chart for USD/CAD using 5-minute time frame.

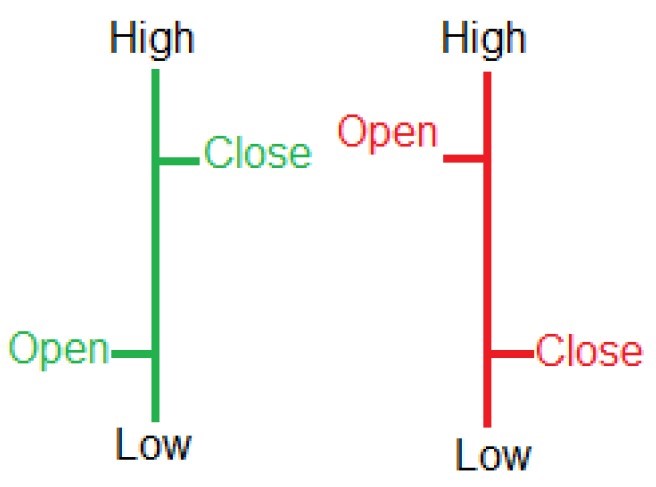

A bar chart gives slightly more information than a line chart because it records the open, high, low, and close of the market price for the currency pair. Unlike the line chart, which gives data at only one point in time, the bar chart offers more data about the price changes during the selected time frame. Bar charts are sometimes referred to as OHLC Charts, because they capture the price for open, high, low, and close.

The OHLC readings on bar charts are:

Open: The horizontal line on the left stands for the opening price

of the

currency pair in a selected time period.

High: The top point of the vertical line shows the highest price

of the

currency pair during that time period.

Low: The bottom point of the vertical line shows the lowest price

of the

currency pair during that time period.

Close: The horizontal line on the right shows the closing price of the currency pair in the selected time period.

The individual vertical bar in the chart (low and high) indicate the currency pair’s trading range as a whole. Depending on the time frame selected, bar charts can summarize price activity over the past minute, hour, day, or even month.

Here is a graph showing the bar chart for AUD/USD in a 4-hour time frame.

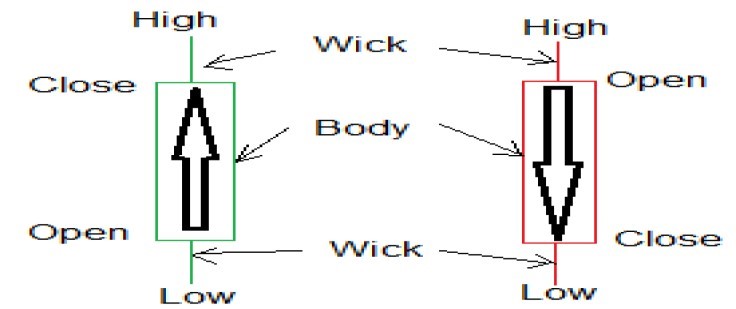

Candlestick charts were invented by the Japanese in the 1700s to study the movements in the price of rice on Japanese commodity exchanges. Candlestick charts show the same information as bar charts but in a more visually appealing way.

The OHLC readings are the same as with bar bar charts. A candlestick is considered bullish if the closing price is higher than the opening price. A candlestick is considered bearish if the closing price is lower than the opening price. In figure, the candlestick on the left is considered bullish and the one on the right is considered bearish.

The “real body” of the candlestick represents the range between the opening price and the closing price for a particular time frame. Real bodies can be either long or short. The “wicks”, or shadows, above and below the candlestick represent the highest and lowest prices reached during a a particular time frame. Shadows can be long or short.

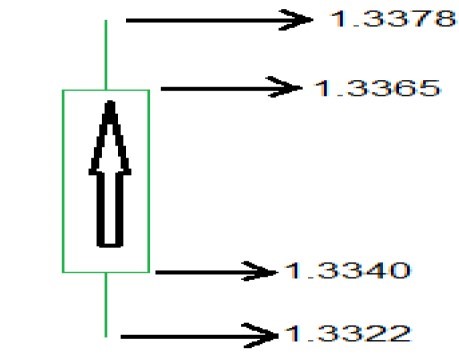

Here is how we would interpret the candlestick, assuming that the candle started forming at 11am. At 11am, the price for EUR/USD was 1.3340. At 11:30am, the price for EUR/USD closed higher at 1.3365. In the half-hour period, prices fluctuated such that the highest price reached was 1.3378 and the lowest price reached was 1.3322.

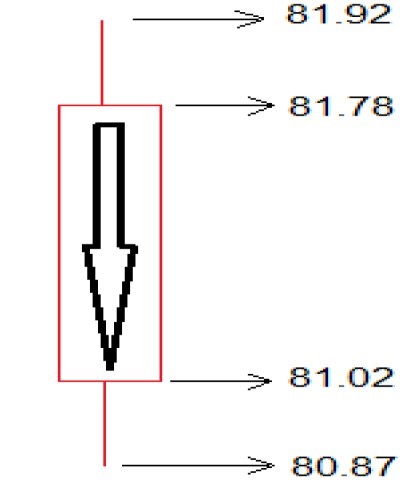

For

the bearish candlesticks, here’s how we would interpret the

candlestick, assuming that the candle started forming at 2pm: at 2pm,

the price

for USD/JPY was 81.78. At 6pm, the price for USD/JPY closed lower at

81.02. In

the 4-hour period, prices fluctuated such that the highest price

reached was

81.92 and the lowest price reached was 80.87.

YOU HAVE COMPLETED THE CHAPTER ONE AND WE HOPE THAT YOU KNOW NOW WHAT THE FINANCIAL MARKET IS ABOUT AND HOW IT WORKS! THANK YOU AND MOVE TO THE CHAPTER TWO WHICH TAKES YOU TO THE TRADING PRACTICE.

© 2024 ETS ROIX. All rights reserved.